We received a call from a tenant. He works shift work and fell asleep while cooking and there was a fire.

Thankfully he is o.k.

His insurance is coming out and will be covering his personal items and damage to the house.

Many tenants want to know why the landlord should be covered by the tenants insurance. This is all about making sure you as a tenant don’t lose your bacon.

Can you imagine what would happen if tenants insurance doesn’t cover the 10 to 20 thousand in damage that is likely to happen here to the house?

The owners insurance company will pay up for house damage (not for damage to your personal belongings) but there is something that happens when an insurance company pays. They do something called subrogation.

Here is the definition from google:

Essentially after subrogation the insurance company as the ability to sue you for any damage. Then you are in a fight with a large company that is going to sick their big fat attorneys on you with bottomless budgets to collect what you most likely don’t even have to pay.

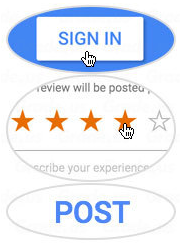

That is why we ask that you both have tenant insurance and that we as landlord be named in that policy for up to $100,000 in liability.